Read Publication 1635, Understanding Your EIN PDF. If you cant find your EIN on any of your documents, you can contact the IRS at 80, but youll need to call them Monday through Friday between 7 a.m. Make your check or money order payable to Internal Revenue Service and show your name (as shown on the SS-4), address, kind of tax, period covered, and the date you applied for your EIN. If you don't have your EIN by the time a deposit is due, send your payment to the service center address for your state. If you don't have your EIN by the time a return is due, write "Applied for" and the date you applied in the space shown for the number.

W2 ein look up pdf#

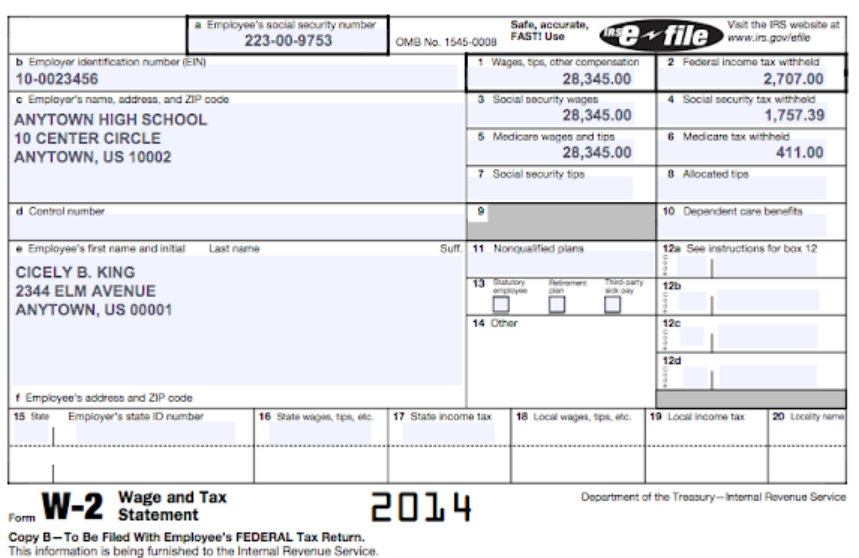

If you apply by mail, send your completed Form SS-4 PDF at least four to five weeks before you need your EIN to file a return or make a deposit. If you do not include a return fax number, it will take about two weeks. If you prefer, you can fax a completed Form SS-4 to the service center for your state, and they will respond with a return fax in about one week. International applicants must call 26 (Not a toll-free number). A business needs to obtain a Minnesota Tax ID (a seven digit number. You can get an EIN immediately by applying online. The Employer Identification Number (EIN), also known as the Federal Employer Identification Number (FEIN) or the Federal Tax Identification Number, is a unique nine-digit number assigned by the Internal Revenue Service (IRS) to business entities operating in the United States for the purposes of identification. Find where to file the form at Where to File Your Taxes for Form SS-4. You should apply for an EIN early enough to have your number when you need to file a return or make a deposit.

0 kommentar(er)

0 kommentar(er)